Terence S. Phillips,

|

Back to Blog

The taboos vary by class, job, and circumstance.  Americans love to talk about how Americans hate to talk about money. Indeed, recent surveys from financial and market-research firms have found that in 34 percent of cohabiting couples (married or not), one or both partners couldn’t correctly identify how much money the other makes; that only 17 percent of parents with an income above $100,000 a year had told (or planned to tell) their children how much they earn or their net worth; and that people are “more comfortable” talking with friends about marital discord, mental health, addiction, race, sex, and politics than money. These results seem to point to a society-wide gag rule that discourages the discussion of financial details. But there are caveats. The companies that tend to publish findings like these stand to gain from persuading people to talk more about their money, if not with their loved ones, then with a professional financial adviser. They’re also, therefore, more likely to be interested in the psychological drama of people who make $100,000 a year than in that of people who make less. Many Americans do have trouble talking about money—but not all of them, not in all situations, and not for the same reasons. In this sense, the “money taboo” is not one taboo but several, each tailored to a different social context. Money taboos are absent, or much weaker, in many countries and cultures outside the U.S., but when the conditions present in those societies exist in certain pockets of America, silence can give way to relative openness. Americans, in other words, are hesitant to talk about money—except for all the times when they aren’t. When I asked Rachel Sherman, a sociologist at the New School, why Americans are reluctant to talk about income and wealth with their friends and families, she responded with her own questions: “What does it mean to ‘talk about money?’ Does it mean saying amounts of money, like [how much you earned last year in] numbers? Because I think that is taboo. But I also think we are kind of constantly talking about money.” She pointed out that everyday conversation is filled with questions about what people buy, what they do for a living, where they went to school, and other subjects that serve as proxies for class position. In fact, money taboos vary a lot based on class. Sherman told me that “people often just feel bad about how much money they have,” so “not talking about it makes that feeling of badness go away.” In interviews with wealthy New Yorkers for her book Uneasy Street: The Anxieties of Affluence, she heard people say that they kept financial details private to spare their friends or children from feeling bad. She suspects that although this rationale is genuine, it’s also “a justification for silence” that prevents people from having to confront the unpleasant fact of their own wealth in an unequal society—that is, they’re ultimately sparing themselves. [Read: Rich people rarely tell their kids how much money they make] Among middle-class Americans, the ban on talking about money is instead often brought on by financial precarity. Caitlin Zaloom, an anthropologist at New York University, interviewed dozens of middle-class families for her recent book Indebted: How Families Make College Work at Any Cost. She told me that to the families she spoke with, being middle class meant not being financially reliant on family, friends, or the government. “Under the conditions of [economic] fragility, protecting a middle-class identity meant silence about money,” she said. “Silence protects the idea that a middle-class family is independent and will be into the future, even if that’s not the case.” In working-class communities, meanwhile, the money taboo can be weaker. Jennifer Silva, a sociologist at Indiana University who has researched the coal-producing region of Pennsylvania, told me that the working-class families she’s interviewed didn’t hesitate to disclose specifics about their income, rent, or expenditures. “People would say, ‘I’m an open book,’ and be straightforward, open, not ashamed,” she said. They freely discussed “the challenges or even impossibilities of supporting a family on minimum-wage work” and “how they would make their budget stretch, such as buying ground meat in bulk and freezing portions to make it last.” “There is a racial difference in how people talk about money,” Frederick Wherry, a sociologist at Princeton University, told me in an email. “By the numbers, the racial wealth gap between African Americans and whites is [roughly] one to 10, so it is hard to have a taboo around something that hardly exists for you.” Some financial struggles may be inescapable, Wherry noted, but certain black communities have developed practices to talk about them with optimism. He cited the “uplifting [tone of] gospel and sermons: ‘Manna from heaven in a time of need,’ ‘the widow’s jar of flour that does not run out.’” Even if no single taboo around money exists across every segment of American culture, it’s possible to take a wider view of the function that financial silences serve. Societies with significant wealth disparities are “inherently unstable,” Jeffrey Winters, a political-science professor at Northwestern University, told me. The idea is that the have-nots fight to claim some resources for themselves while the haves fight to defend what they own, whether violently or more subtly. Thus, taboos around money—among haves and have-nots alike—exert a sort of stabilizing force, blurring how much people actually have and giving them one fewer reason to be upset with their place in society. “The bubbles of denial that people operate within are sustained by taboos on talking about money, which in turn helps sustain the unequal society itself,” Winters said. One common explanation for the particular sway money taboos hold over Americans is, as Zaloom put it, the widely held belief that “your value as a human being is somehow made material in your pay and in your accounts.” If people were to publicly reveal their income, Zaloom said, they’d be “exposing how they’re valued by their employer and how their contribution is valued even more broadly, by the community.” [Read: Who actually feels satisfied about money?] Other researchers I consulted had different, but no less compelling, theories as to why direct discussions of money can produce social tension in any society. “Money gets tied up in all sorts of moral problems and provokes taboos because its special task is to translate qualities into quantities,” Gustav Peebles, an anthropology professor at the New School, told me. “Anything that is for sale has a host of qualities—even a jug of milk—that necessarily must be reduced to a singular price.” He noted that pricing a gallon of milk might not itself pose a moral dilemma, but this conversion of the subjective to the ostensibly objective is more fraught when it involves human labor and value. Jeremy Jones, an anthropologist at the College of the Holy Cross who has studied cultures of money in Zimbabwe, hypothesizes that people’s openness about a particular expenditure or investment might have to do with the time horizon associated with it. To take one example, debt can be such a sensitive subject because “the ramifications of [it] can extend far beyond the here and now,” he told me. Meanwhile, inquiring about the cost of a friend’s lunch yesterday—a transaction with likely limited connections to the past and future—generally isn’t off-limits. But if the time horizon of that small purchase were extended—if that friend were trying to save aggressively to buy a house in five years, and wanted to avoid expensive lunches—the money spent would become more loaded with meaning, and possibly shame. The time-related taboos that Jones described have likely been around for a while, but the particular taboos around talking about money in present-day America are probably about a century and a half old, according to Eli Cook, a history professor at the University of Haifa and the author of The Pricing of Progress: Economic Indicators and the Capitalization of American Life. “In the late 19th century and early 20th century, I think many Americans internalized the lessons of mainstream neoclassical economics, which suggested, through [the economist] John Bates Clark’s theory of marginal productivity, that everyone earns what they in fact produced,” Cook told me. Before this period of industrialization, Cook said, workers had less of an expectation that their pay would reflect their talents and abilities, because they were well aware of the leverage their employers had in setting wages; but in the 20th century, as those economic ideas took hold, wages became something that workers might deduce their own worth from. Similarly, Zaloom traces the link between financial value and personal value to the German sociologist Max Weber’s work The Protestant Ethic and the Spirit of Capitalism, which was published at the beginning of the 20th century. James Suzman, an anthropologist who has studied and written about the Ju/’hoansi, a group in southern Africa that lived as hunter-gatherers well into the 20th century, has seen money taboos develop firsthand. When different groups of Ju/’hoansi first encountered money at various times in the past half century, Suzman told me in an email, they didn’t have any qualms about discussing it. But after the introduction of money and wage labor, Suzman said, “people who earned money soon become circumspect about talking about it among those who didn’t, largely because if they talked about it, others would demand a share, often putting strain on relationships.” But even though wage labor is common throughout the rest of the world, it does not necessarily produce taboos like the ones in the U.S. Cook told me that in Israel, some people openly discuss salary information. He attributes this to a range of potential factors, including a lower cultural premium on privacy, higher levels of unionization (“Once it’s collective bargaining, it’s not as personal”), a sense of society-wide solidarity (“There is a notion that ‘Together we can make sure the boss isn’t screwing us’”), and a desire to seem savvy (“People like to show off that they are good hagglers and will brag how they got the best deal. They do this with everything—why not salaries?”). [Read: Ask your (male) colleagues what they earn] Other societies provide examples of how financial value need not be equated with personal value. Kimberly Chong, an anthropology lecturer at University College London, told me that when she studied the office of an American consulting firm in China, the mostly Chinese consultants “freely shared information about how much they earned with each other and also felt emboldened to ask senior executives how much they earned.” To the frustration of management, this made it difficult to sustain the pay differentials that are common at American companies. In America, “asking someone what they earn is considered taboo because you are indirectly questioning their personal worth,” Chong writes in her book Best Practice: Management Consulting and the Ethics of Financialization in China. “By contrast, in China personal worth is not primarily indexed to financial worth, but rather one’s ‘quality’ (suzhi), the moral and ethical values that cannot be reduced to economic value.” When conditions like those in Israel and China are introduced into certain segments of American society, money taboos can dissolve. Zaloom noted two contexts in which American workers’ pay is less connected to their perceived worth: unions and government jobs. “In unions, everybody knows how much everybody else gets paid, because it’s a part of contract negotiations,” she said—the feeling of being valued in a certain way by the larger economy might still be present, but so is the sense that one’s pay is simply the product of the union’s negotiating power. The outcome is similar for public workers, whose pay is often standardized, and determined by clearly defined criteria. “There’s a bureaucratic rationality to the pay that disconnects it from a sense of moral responsibility,” Zaloom said. Money also becomes more openly discussed under particular household circumstances, as Viviana Zelizer, a sociologist at Princeton, pointed out to me. “We know taboos are broken during various times of crisis,” she said, noting the examples of divorce or a family illness. In many countries, the taboos around talking about money are weaker not because of collective bargaining or standardized pay, but because people’s livelihood often depends on a full and accurate accounting of each household member’s earnings, expenditures, and deals. “In some societies, the money taboo is instead constant chatter—how much things cost, how much jobs pay, how much the currency is worth—as a way of making sense of one’s place in the world,” Allison Truitt, an anthropology professor at Tulane University, told me. She cited Vietnam as an example of one such society where people tend to talk more directly about money. In part, that’s the case because earnings are relatively low and arrive at irregular intervals, which sparks speculation in everyday conversation. It also has to do with the fact that some people depend on remittances from relatives abroad, so discussions of financial specifics naturally feature in family life. [Read: How money became the measure of everything] Similar forms of this “constant chatter” are found elsewhere as well. In a 2018 article for Vice, the writer Paulette Perhach noted that in Paraguay, “people openly ask how much you make, how much your phone costs, and even, one time when I handed someone a present, how much I paid for it. When I told the birthday girl how much her gift was, she chided me that I’d overpaid, and told me I should have gone to another store for a better price.” These Paraguayan and Vietnamese examples don’t map cleanly onto American communication habits, but their matter-of-fact approach to money is reminiscent of the “open-book” mentality that Jennifer Silva noticed in American working-class households where money was tight. Even if America’s money taboos are not exceptional, their strength derives from conditions particular to the U.S. “I think it has something to do with the incompatibility of the idea that we have a democracy in which all citizens are equal and the fact that we have a class system that produces a lot of inequality,” said Rachel Sherman, the sociologist. Other countries might have high levels of inequality too, she noted, but perhaps weaker democratic ideals and less faith in meritocracy. But worldwide, a sensitivity to money, and to the significance of having a lot of it, is on some level inescapable—monitoring and modulating the financial signals one sends seem to be nearly universal impulses. Parfait Eloundou-Enyegue, a development-sociology professor at Cornell University, told me that when income or wealth is invoked as a status symbol, it can spark a competition with others that will be unpleasant for all involved. “For that reason,” he said, “people will refrain from the most blatant forms of self-puffery unless they are absolutely necessary or effective.” “If you must display your money, you strategically select occasions that draw sympathy and avert the retaliatory arms race,” Eloundou-Enyegue said. “In Ghana, for instance, families may spend large fortunes on elaborate funerals, to display wealth under the veil of grieving.” As a society or group becomes more affluent, he said, overt status displays become more frowned upon—hence wealthy Americans’ (only slightly) subtler references to certain zip codes, vacation destinations, or private schools. Sherman raised the point that, for the purposes of sizing up a peer, those proxies for class position might even be more useful than knowing someone’s precise income. That is to say, in some cases, Americans might not talk about money in precise terms simply because they don’t need to. When clues like where you live, where you went to school, and where you travel are mentioned in conversation, Sherman said, “the number almost becomes unnecessary.” -Joe Pinsker

0 Comments

Read More

Your comment will be posted after it is approved.

Leave a Reply. |

ServicesVenture Capital Major Project Funding

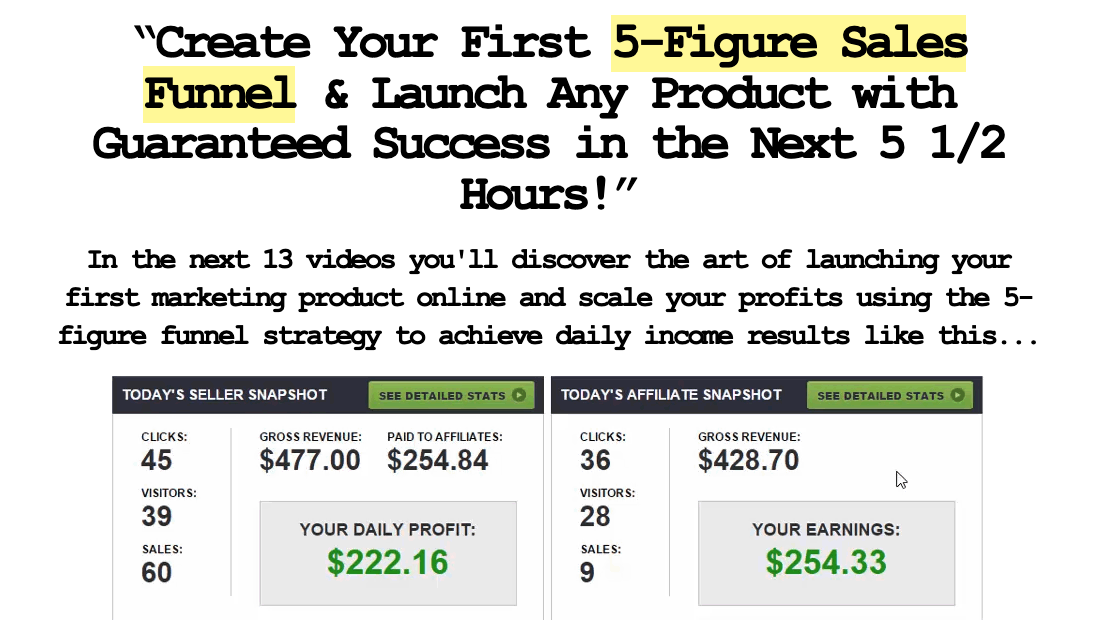

Business Loans Church Loans Affordable Health Insurance Plans Kingdom Partnerships TSP 121 Coaching My Online Digital Empire VIP Ticket Orders |

Company |

|

“We are a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for us to earn fees by linking to Amazon.com and affiliated sites.”

TSP Financial Group, LLC © COPYRIGHT 2015-2030. ALL RIGHTS RESERVED.

13650 FIDDLESTICKS BLVD. SUITE 202-175, FORT MYERS, FLORIDA 33912

O: 877.528.0702 | F: 239.236.0211 | INFO@TSPFINANCIALGROUP.COM

13650 FIDDLESTICKS BLVD. SUITE 202-175, FORT MYERS, FLORIDA 33912

O: 877.528.0702 | F: 239.236.0211 | INFO@TSPFINANCIALGROUP.COM

RSS Feed

RSS Feed