Terence S. Phillips,

|

Back to Blog

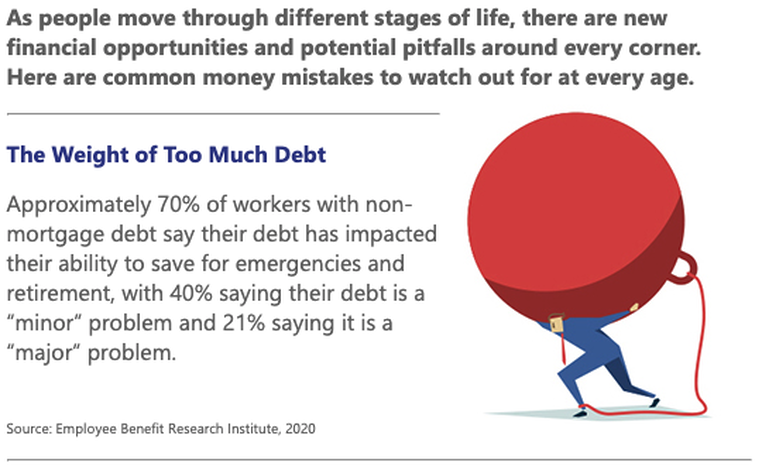

Your 20s & 30s Being financially illiterate. By learning as much as you can about saving, budgeting, and investing now, you could benefit from it for the rest of your life. Not saving regularly. Save a portion of every paycheck and then spend what’s left over — not the other way around. You can earmark savings for short-, medium-, and long-term goals. A variety of mobile apps can help you track your savings progress. Living beyond your means. This is the corollary of not saving. If you can’t manage to stash away some savings each month and pay for most of your expenses out-of-pocket, then you need to rein in your lifestyle. Start by cutting your discretionary expenses and then look at ways to reduce your fixed costs. Spending too much on housing. Think twice about buying a house or condo that will stretch your budget to the max, even if a lender says you can afford it. Consider building in space for a possible dip in household income that could result from a job change or a leave from the workforce to care for children. Overlooking the cost of subscriptions and memberships. Keep on top of services you are paying for (e.g., online streaming, cable, the gym, your smartphone bill, food delivery) and assess whether they still make sense on an annual basis. Not saving for retirement. Perhaps saving for retirement wasn’t on your radar in your 20s, but you shouldn’t put it off in your 30s. Start now and you still have 30 years or more to save. Wait much longer and it can be hard to catch up. Start with whatever amount you can afford and add to it as you’re able. Not protecting yourself with insurance. Consider what would happen if you were unable to work and earn a paycheck. Life insurance and disability income insurance can help protect you and your family. Your 40s Not keeping your job skills fresh. Your job is your lifeline to income, employee benefits, and financial security. Look for opportunities to keep your skills up-to-date and stay abreast of new workplace developments and job search technologies. Spending to keep up with others. Avoid spending money you don’t have trying to keep up with your friends, family, neighbors, or colleagues. The only financial life you need to think about is your own. Funding college over retirement. Don’t prioritize saving for college over saving for retirement. If you have limited funds, consider setting aside a portion for college while earmarking the majority for retirement. Closer to college time, have a frank discussion with your child about college options and look for creative ways to help reduce college costs. Using your home equity like a bank. The goal is to pay off your mortgage by the time you retire or close to it — a milestone that will be much harder to achieve if you keep moving the goalposts. Ignoring your health. By taking steps now to improve your fitness level, diet, and overall health, not only will you feel better today but you may reduce your health-care costs in the future. Your 50s & 60s

Co-signing loans for adult children. Co-signing means you’re 100% on the hook if your child can’t pay — a less-than-ideal situation as you approach retirement. Raiding your retirement funds before retirement. It goes without saying that dipping into your retirement funds will reduce your nest egg — a significant tradeoff for purchases that aren’t true emergencies. Not knowing your sources of retirement income. As you near retirement, you should know how much money you (and your partner, if applicable) can expect from three sources: your personal retirement accounts (e.g., 401(k) plans and IRAs); pension income from an employer; and Social Security at age 62, full retirement age, and age 70. Not having a will or advance medical directive. No one likes to think about death or catastrophic injury, but these documents can help your loved ones immensely if something unexpected should happen to you. This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek guidance from an independent tax or legal professional. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2021 Broadridge Financial Solutions, Inc.

0 Comments

Read More

Your comment will be posted after it is approved.

Leave a Reply. |

ServicesVenture Capital Major Project Funding

Business Loans Church Loans Affordable Health Insurance Plans Kingdom Partnerships TSP 121 Coaching My Online Digital Empire VIP Ticket Orders |

Company |

|

“We are a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for us to earn fees by linking to Amazon.com and affiliated sites.”

TSP Financial Group, LLC © COPYRIGHT 2015-2030. ALL RIGHTS RESERVED.

13650 FIDDLESTICKS BLVD. SUITE 202-175, FORT MYERS, FLORIDA 33912

O: 877.528.0702 | F: 239.236.0211 | INFO@TSPFINANCIALGROUP.COM

13650 FIDDLESTICKS BLVD. SUITE 202-175, FORT MYERS, FLORIDA 33912

O: 877.528.0702 | F: 239.236.0211 | INFO@TSPFINANCIALGROUP.COM

RSS Feed

RSS Feed