Terence S. Phillips,

|

Back to Blog

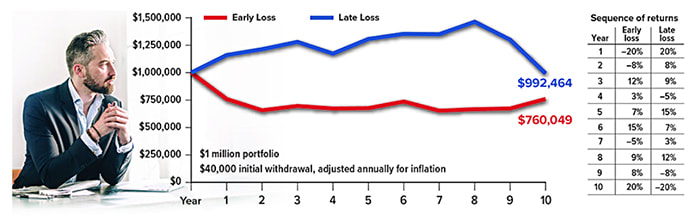

“You can’t time the market” is an old maxim, but you also might say, “You can’t always time retirement.” Market losses on the front end of retirement could have an outsized effect on the income you receive from your portfolio by reducing the assets available to pursue growth when the market recovers. The risk of experiencing poor investment performance at the wrong time is called sequence risk or sequence-of-returns risk. Early Losses A significant market downturn during the first two years of retirement could make a big difference in the size of a portfolio after 10 years, compared with having the same downturn at the end of the 10-year period. Both scenarios are based on the same returns, but in reverse order. Assumes a $40,000 withdrawal in Year 1, with subsequent annual withdrawals increased by an inflation factor of 2%. This hypothetical example of mathematical principles is used for illustrative purposes only and does not represent the performance of any specific investment. Fees, expenses, and taxes are not considered and would reduce the performance shown if they were included. Actual results will vary.

Dividing Your Portfolio One strategy that may help address sequence risk is to divide your retirement portfolio into three different “baskets” that could provide current income, regardless of market conditions, and growth potential to fund future income. Although this method differs from the well-known “4% rule,” an annual income target around 4% of your original portfolio value might be a reasonable starting point, with adjustments based on changing needs, inflation, and market returns. Basket #1: Short term (1 to 3 years of income). This basket holds stable liquid assets such as cash and cash alternatives that could provide income for one to three years. Having sufficient cash reserves might enable you to avoid selling growth-oriented investments during a down market. Basket #2: Mid term (5 or more years of income). This basket — equivalent to five or more years of your needed income — holds mostly fixed-income securities such as intermediate- and longer-term bonds that have moderate growth potential with low or moderate volatility. It might also include some lower-risk, income-producing equities. The income from this basket can flow directly into Basket #1 to keep it replenished as the cash is used for living expenses. If necessary during a down market, some of the securities in this basket could be sold to replenish Basket #1. Basket #3: Long term (future income). This basket is the growth engine of the portfolio and holds stocks and other investments that are typically more volatile but have higher long-term growth potential. Investment gains from Basket #3 can replenish both of the other baskets. In a typical 60/40 asset allocation, you might put 60% of your portfolio in this basket and 40% spread between the other two baskets. Your actual percentages will depend on your risk tolerance, time frame, and personal situation. With the basket strategy, it’s important to start shifting assets before you retire, at least by establishing a cash cushion in Basket #1. There is no guarantee that putting your nest egg in three baskets will be more successful in the long term than other methods of drawing down your retirement savings. But it may help you better visualize your portfolio structure and feel more confident about your ability to fund retirement expenses during a volatile market. All investments are subject to market fluctuation, risk, and loss of principal. Asset allocation does not guarantee a profit or protect against investment loss. The principal value of cash alternatives may be subject to market fluctuations, liquidity issues, and credit risk. Bonds redeemed prior to maturity may be worth more or less than their original cost. Investments seeking to achieve higher yields also involve higher risk. This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek guidance from an independent tax or legal professional. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2021 Broadridge Financial Solutions, Inc.

0 Comments

Read More

Your comment will be posted after it is approved.

Leave a Reply. |

ServicesVenture Capital Major Project Funding

Business Loans Church Loans Affordable Health Insurance Plans Kingdom Partnerships TSP 121 Coaching My Online Digital Empire VIP Ticket Orders |

Company |

|

“We are a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for us to earn fees by linking to Amazon.com and affiliated sites.”

TSP Financial Group, LLC © COPYRIGHT 2015-2030. ALL RIGHTS RESERVED.

13650 FIDDLESTICKS BLVD. SUITE 202-175, FORT MYERS, FLORIDA 33912

O: 877.528.0702 | F: 239.236.0211 | INFO@TSPFINANCIALGROUP.COM

13650 FIDDLESTICKS BLVD. SUITE 202-175, FORT MYERS, FLORIDA 33912

O: 877.528.0702 | F: 239.236.0211 | INFO@TSPFINANCIALGROUP.COM

RSS Feed

RSS Feed