Terence S. Phillips,

|

Back to Blog

If you are engaged to be married, or expect to be soon, it’s important to consider how this change in the relationship (and legal status) will affect your finances. Discussing the following topics well in advance may keep surprises and disagreements from disrupting your newlywed bliss. Share debt stories. Many Americans bring college debt into their marriages, and some individuals have had severe credit challenges. Taking a close look at both credit reports may help resolve debt and credit issues before they spiral out of control. Discuss banking and bill paying. Working together to prepare a preliminary household budget may help you start off on the right foot. If you decide not to pool all your income and assets, make sure you clearly define what belongs to each of you separately and what responsibilities you will share. Some married couples use a joint account for living expenses and separate accounts for personal spending. Look closely at company health plans. You may need to coordinate two sets of workplace benefits, so keep in mind that many companies apply a surcharge to encourage a worker’s spouse to use other available coverage. Compare the costs and benefits of having both of you on the same plan versus keeping your individual coverage with each employer.

Anticipate joint income taxes. Most married couples pay more total tax when they file separately than when they file jointly. But there are rare occasions when filing separate returns could result in a lower combined tax liability or provide another benefit. For example, if you or your fiancé have federal student loans, filing separately might help you qualify for a lower monthly payment under an income-based repayment plan. Combining your incomes could land you in a higher (or lower) tax bracket, so you may want to check and adjust your employer withholding to avoid owing money at tax time. If you expect a larger refund, you might reduce your withholding and put that money to better use (such as paying off debt or boosting savings). Consider a prenuptial agreement. A prenup is a written contract that states how assets will be owned during the marriage and divided in the event of divorce. A prenup may be unnecessary if the engaged couple are both young and have comparable wealth levels. But if either partner owns (or expects to inherit) substantial assets — or has significant debts — crafting a premarital agreement may be worthwhile. Prenups are commonly used to help protect the financial interests of children from a previous marriage or to account for other special circumstances. If a couple intends to pay off one partner’s student loans together early in the marriage, an agreement might credit the other spouse for that help in the event of a divorce. Similarly, if one partner expects to support a spouse through professional school (law or medical), an agreement may stipulate how he or she will share fairly in the professional’s future income. This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2019 Broadridge Investor Communication Solutions, Inc.

0 Comments

Read More

Your comment will be posted after it is approved.

Leave a Reply. |

ServicesVenture Capital Major Project Funding

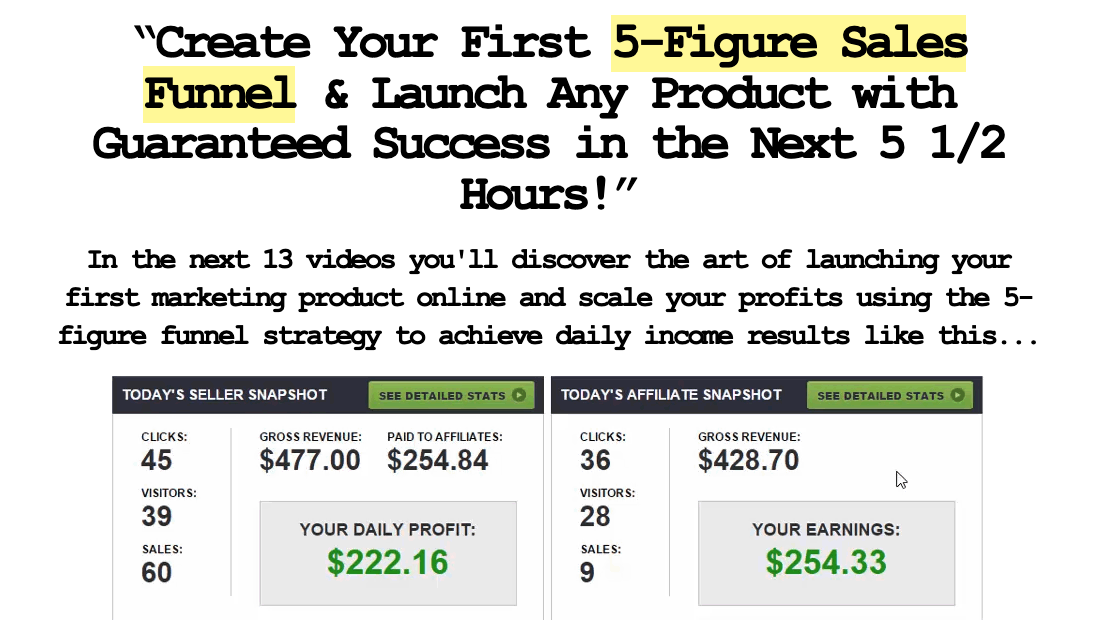

Business Loans Church Loans Affordable Health Insurance Plans Kingdom Partnerships TSP 121 Coaching My Online Digital Empire VIP Ticket Orders |

Company |

|

“We are a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for us to earn fees by linking to Amazon.com and affiliated sites.”

TSP Financial Group, LLC © COPYRIGHT 2015-2030. ALL RIGHTS RESERVED.

13650 FIDDLESTICKS BLVD. SUITE 202-175, FORT MYERS, FLORIDA 33912

O: 877.528.0702 | F: 239.236.0211 | INFO@TSPFINANCIALGROUP.COM

13650 FIDDLESTICKS BLVD. SUITE 202-175, FORT MYERS, FLORIDA 33912

O: 877.528.0702 | F: 239.236.0211 | INFO@TSPFINANCIALGROUP.COM

RSS Feed

RSS Feed