Terence S. Phillips,

|

Back to Blog

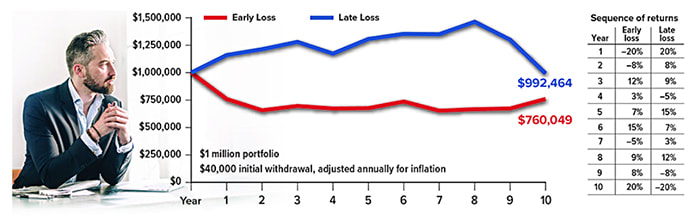

“You can’t time the market” is an old maxim, but you also might say, “You can’t always time retirement.” Market losses on the front end of retirement could have an outsized effect on the income you receive from your portfolio by reducing the assets available to pursue growth when the market recovers. The risk of experiencing poor investment performance at the wrong time is called sequence risk or sequence-of-returns risk. Early Losses A significant market downturn during the first two years of retirement could make a big difference in the size of a portfolio after 10 years, compared with having the same downturn at the end of the 10-year period. Both scenarios are based on the same returns, but in reverse order. Assumes a $40,000 withdrawal in Year 1, with subsequent annual withdrawals increased by an inflation factor of 2%. This hypothetical example of mathematical principles is used for illustrative purposes only and does not represent the performance of any specific investment. Fees, expenses, and taxes are not considered and would reduce the performance shown if they were included. Actual results will vary.

Dividing Your Portfolio One strategy that may help address sequence risk is to divide your retirement portfolio into three different “baskets” that could provide current income, regardless of market conditions, and growth potential to fund future income. Although this method differs from the well-known “4% rule,” an annual income target around 4% of your original portfolio value might be a reasonable starting point, with adjustments based on changing needs, inflation, and market returns. Basket #1: Short term (1 to 3 years of income). This basket holds stable liquid assets such as cash and cash alternatives that could provide income for one to three years. Having sufficient cash reserves might enable you to avoid selling growth-oriented investments during a down market. Basket #2: Mid term (5 or more years of income). This basket — equivalent to five or more years of your needed income — holds mostly fixed-income securities such as intermediate- and longer-term bonds that have moderate growth potential with low or moderate volatility. It might also include some lower-risk, income-producing equities. The income from this basket can flow directly into Basket #1 to keep it replenished as the cash is used for living expenses. If necessary during a down market, some of the securities in this basket could be sold to replenish Basket #1. Basket #3: Long term (future income). This basket is the growth engine of the portfolio and holds stocks and other investments that are typically more volatile but have higher long-term growth potential. Investment gains from Basket #3 can replenish both of the other baskets. In a typical 60/40 asset allocation, you might put 60% of your portfolio in this basket and 40% spread between the other two baskets. Your actual percentages will depend on your risk tolerance, time frame, and personal situation. With the basket strategy, it’s important to start shifting assets before you retire, at least by establishing a cash cushion in Basket #1. There is no guarantee that putting your nest egg in three baskets will be more successful in the long term than other methods of drawing down your retirement savings. But it may help you better visualize your portfolio structure and feel more confident about your ability to fund retirement expenses during a volatile market. All investments are subject to market fluctuation, risk, and loss of principal. Asset allocation does not guarantee a profit or protect against investment loss. The principal value of cash alternatives may be subject to market fluctuations, liquidity issues, and credit risk. Bonds redeemed prior to maturity may be worth more or less than their original cost. Investments seeking to achieve higher yields also involve higher risk. This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek guidance from an independent tax or legal professional. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2021 Broadridge Financial Solutions, Inc.

0 Comments

Read More

Back to Blog

Your 20s & 30s Being financially illiterate. By learning as much as you can about saving, budgeting, and investing now, you could benefit from it for the rest of your life. Not saving regularly. Save a portion of every paycheck and then spend what’s left over — not the other way around. You can earmark savings for short-, medium-, and long-term goals. A variety of mobile apps can help you track your savings progress. Living beyond your means. This is the corollary of not saving. If you can’t manage to stash away some savings each month and pay for most of your expenses out-of-pocket, then you need to rein in your lifestyle. Start by cutting your discretionary expenses and then look at ways to reduce your fixed costs. Spending too much on housing. Think twice about buying a house or condo that will stretch your budget to the max, even if a lender says you can afford it. Consider building in space for a possible dip in household income that could result from a job change or a leave from the workforce to care for children. Overlooking the cost of subscriptions and memberships. Keep on top of services you are paying for (e.g., online streaming, cable, the gym, your smartphone bill, food delivery) and assess whether they still make sense on an annual basis. Not saving for retirement. Perhaps saving for retirement wasn’t on your radar in your 20s, but you shouldn’t put it off in your 30s. Start now and you still have 30 years or more to save. Wait much longer and it can be hard to catch up. Start with whatever amount you can afford and add to it as you’re able. Not protecting yourself with insurance. Consider what would happen if you were unable to work and earn a paycheck. Life insurance and disability income insurance can help protect you and your family. Your 40s Not keeping your job skills fresh. Your job is your lifeline to income, employee benefits, and financial security. Look for opportunities to keep your skills up-to-date and stay abreast of new workplace developments and job search technologies. Spending to keep up with others. Avoid spending money you don’t have trying to keep up with your friends, family, neighbors, or colleagues. The only financial life you need to think about is your own. Funding college over retirement. Don’t prioritize saving for college over saving for retirement. If you have limited funds, consider setting aside a portion for college while earmarking the majority for retirement. Closer to college time, have a frank discussion with your child about college options and look for creative ways to help reduce college costs. Using your home equity like a bank. The goal is to pay off your mortgage by the time you retire or close to it — a milestone that will be much harder to achieve if you keep moving the goalposts. Ignoring your health. By taking steps now to improve your fitness level, diet, and overall health, not only will you feel better today but you may reduce your health-care costs in the future. Your 50s & 60s

Co-signing loans for adult children. Co-signing means you’re 100% on the hook if your child can’t pay — a less-than-ideal situation as you approach retirement. Raiding your retirement funds before retirement. It goes without saying that dipping into your retirement funds will reduce your nest egg — a significant tradeoff for purchases that aren’t true emergencies. Not knowing your sources of retirement income. As you near retirement, you should know how much money you (and your partner, if applicable) can expect from three sources: your personal retirement accounts (e.g., 401(k) plans and IRAs); pension income from an employer; and Social Security at age 62, full retirement age, and age 70. Not having a will or advance medical directive. No one likes to think about death or catastrophic injury, but these documents can help your loved ones immensely if something unexpected should happen to you. This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek guidance from an independent tax or legal professional. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2021 Broadridge Financial Solutions, Inc.

Back to Blog

Full House: Adult Children Coming Home11/16/2020 Almost 3 million adults moved in with a parent or grandparent during the months of March, April, and May 2020.1 A large percentage of them were college students returning home early because their campuses shut down, but many were young adults who had launched careers and were living on their own. Some returned because their family home was a safer place to quarantine, while others lost jobs or faced other economic hardships. Although COVID-19 has created a unique situation, there was already a shift to living in the family home. In 2014, a third of young adults ages 18 to 34 were living with a parent, up from one out of five in 1960. And for the first time on record, dating back to 1880, the percentage of young adults living with a parent was higher than the percentage living with a spouse or partner in their own household.2 Having your adult child live with you can offer precious family time and new opportunities to get to know one another as you are today. But it can also be a challenge. Here are some ideas to help ensure a peaceful and productive living situation.

Treat your child like an adult. When an adult child returns to the family home, it’s easy to fall into old patterns and old roles. Both generations need to work to avoid this, but you can take a big step by treating your child respectfully, as you would with any other adult in your home. Have a plan and a purpose. Discuss the reasons for moving back home and the time your child expects to stay. Is it until public health conditions improve? Until he or she finds a job? While completing education? Open-ended? You both may have to be flexible, but it helps to have a road map. Agree on ground rules. Develop a plan for sharing chores, making meals, and buying groceries. Discuss schedules for work, sleep, and other activities, and respect the need for privacy and quiet time. Look for solutions together rather than dictating hard-and-fast rules. Require some cost sharing. If your son or daughter is working, consider charging a low level of rent (especially if you are still paying a mortgage) and/or a portion of other household expenses. On the other hand, if your child is out of a job, paying off student debt, or saving for a specific goal such as a security deposit on an apartment or a down payment on a house or car, you might pay all housing expenses for a period of time. A working young adult who is on your mobile phone plan or covered by your medical insurance should pay an appropriate share of the monthly phone charges and out-of-pocket medical expenses. Establish whether monetary help is a gift or a loan. Allowing your adult child to live with you is one thing, but paying his or her personal expenses is a different level of support. Depending on your child’s age and overall financial situation, you might make direct financial help a loan with a realistic repayment schedule. 1) The Atlantic, July 3, 2020 2) Pew Research Center, 2016 (most recent data available) This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek guidance from an independent tax or legal professional. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2020 Broadridge Investor Communication Solutions, Inc.

Back to Blog

More doses will be available each week as manufacturing ramps up, even as state and local officials complain they don’t have the funds needed to do mass vaccinations The federal government plans to send 6.4 million doses of pharmaceutical giant Pfizer’s coronavirusvaccine to communities across the United States within 24 hours of regulatory clearance, with the expectation that shots will be administered quickly to front-line health-care workers, the top priority group, officials said Tuesday. Gen. Gustave Perna, who oversees logistics for Operation Warp Speed, the Trump administration’s effort to speed up treatments and vaccines, told reporters that state officials were informed on Friday night of the allocation, which is based on each state’s overall population. The amount would cover only a portion of the nation’s 20 million health-care workers, let alone the U.S. population of 330 million. But Perna said “a steady drumbeat” of additional doses will be delivered as manufacturing capacity ramps up in each successive week. With increased prospects that federal regulators will authorize the Pfizer vaccine on an emergency basis as early as mid-December, and that the first shots could be administered before the end of the year, Operation Warp Speed has begun to release more details about the massive and complicated distribution effort to immunize tens of millions of Americans. Covid-19 vaccine distribution and shipping: How it will actually work U.S. government officials are on track to have 40 million doses of vaccines from Pfizer and a second company, biotech firm Moderna, by the end of the year, enough to vaccinate 20 million people. (Each vaccine requires two doses.) It is likely to be April before the general public begins to get vaccinated. The initial batch of 6.4 million doses also includes vaccines that would go to five federal agencies — the Bureau of Prisons, the Defense and State departments, Indian Health Service and the Veterans Health Administration — that receive allocations directly from the federal government. U.S. government officials are on track to have 40 million doses of coronavirus vaccines from Pfizer and a second company, biotech firm Moderna, by year's end, enough to vaccinate 20 million people. (Joel Saget/AFP/Getty Images) States and territories now have the necessary information to “plan and figure out where they want the vaccine distributed” in the first shipment, Perna said. States are supposed to designate their top five sites capable of receiving and administering the Pfizer vaccine, which must be stored at a temperature of minus-70 Celsius (minus-94 Fahrenheit), and has exacting handling protocols. The ultracold temperature is significantly below the standard for most vaccines of 2 to 8 degrees Celsius (36 to 46 degrees Fahrenheit). Many states have designated large hospital systems to be the first places to receive vaccines because they have ultracold freezers and can efficiently vaccinate many people. The minimum order for the Pfizer vaccine is 975 doses; for Moderna, with a storage temperature that does not require such freezers, the minimum order is 100. Once a vaccine is cleared by the FDA, an independent advisory panel to the Centers for Disease Control and Prevention — the Advisory Committee on Immunization Practices — will hold a public meeting within 48 hours to vote on final recommendations for the vaccine’s use and who should get the first shots. Health-care workers will be the first priority, the group has said. About 3 million residents of long-term care facilities are also likely to be included in that first phase. Next in line will be an estimated 87 million other essential workers, including first responders, teachers and grocery workers; more than 100 million adults with high-risk medical conditions; and about 53 million adults over the age of 65. Within 24 hours of FDA action, doses will be “pre-positioned” at the sites designated by each state to give the shots to the first groups.

Pfizer has been conducting dry runs of each step, from vaccine delivery to opening Pfizer’s GPS-tracked special containers to vaccine storage, Perna said. The company began working last week with four states — Rhode Island, Texas, New Mexico and Tennessee — to familiarize personnel with storage and handling requirements. These dry runs do not include actual vaccines, or the dry ice that will be used to keep the vials cold. Additional rehearsals in coming weeks will include dry ice, a federal health official said, speaking on the condition of anonymity because they were not authorized to speak publicly. Those “lessons learned” are being shared with other officials, Perna said. There was “initial hesitation” from some personnel at the sites, he said, but “we expect to see growing confidence in people that are using it.” Americans will receive the vaccine free. The federal government is paying for much of the delivery and vaccine administration costs. But funding remains a big issue for state and local officials, who are asking Congress for at least $8 billion for vaccination efforts; to date, $200 million in federal funds has been sent to state, territorial and local jurisdictions to help them prepare. Federal officials are sending another $140 million in December. Jeff Duchin, a top official at the Seattle and King County health department, said the more than $10 billion in taxpayer dollars spent on development of coronavirus vaccines by Operation Warp Speed was appropriate. “But it’s been more like Operation Status Quo with respect to providing the federal funding needed for state and local health departments to actually get vaccine to the population, including the initial priority populations and ultimately, to as many people as possible,” he said in an email Tuesday. State and local officials say much of the critical planning and implementation work needed for distribution is not adequately funded or staffed. That work includes planning with a broad range of health-care providers for the necessary training and upgrading information systems to vaccinate hard-to-reach and undeserved populations, Duchin said. Health-care providers also need to track allocations and vaccinations administered, and ensure people come back for second doses. Public health officials also need to do outreach with local communities that are hesitant about getting the vaccine, he said. “Tens of millions of dollars are needed for this work in our county and state,” he said. “In addition, this work is tasked to local and state public health departments and workers, who have been grappling with this pandemic nonstop for months and are running on fumes.” By Lena H. Sun

Back to Blog

The Bitcoin Documentary Summary and Information

The cryptocurrency paradigm was heralded by the launch of Bitcoin (BTC) in 2008, inspiring a new technological and social movement. The goal of cryptocurrencies is to provide a medium for global, peer-to-peer transaction settlement that preserves privacy and financial security.

A cryptocurrency monetary policy is enforced through a unique blend of software, cryptography and financial incentives rather than the whim of trusted third parties such as central banks, corporations or governments. Cryptocurrencies are powered by cryptographically secure, verifiable transaction databases called blockchains, which provide their security and transparency. A cryptocurrency network consists of a global community of stakeholders, including the validators that secure the network while adding transactions to the blockchain, the traders who speculate on these radically market-driven assets, and the builders working to onboard people to this new financial paradigm. At Cointelegraph, we are chronicling the ongoing story of cryptocurrency and the rise of a borderless, permissionless financial system. How will industry stakeholders work to make crypto a mainstay in people’s lives? How will crypto investments change the paradigm of the current financial system? And will incumbent and legacy systems accept or fight this change?

Stay tuned: Cryptocurrencies are going to play a big role heading into the future.

Don't Get Left Behind!

Back to Blog

A Brief History of the Crypto Industry

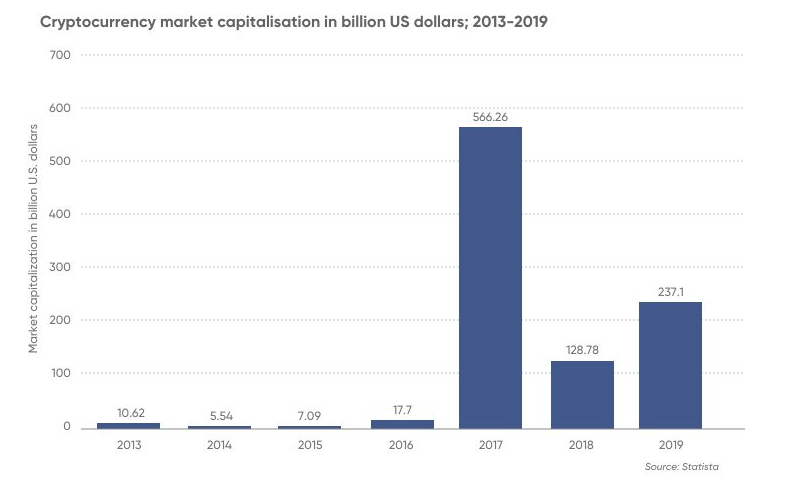

The cryptocurrency industry has grown substantially since Satoshi Nakamoto published the original Bitcoin whitepaper in 2008. More than a decade later, most people are aware of the terms “Bitcoin” and “cryptocurrency”. In 2017, at the peak of the interest in cryptocurrencies, “How to buy BTC” was the third-ranked “How to …” Google search. While the market capitalisation of the crypto asset class has fluctuated wildly with price swings, it nevertheless increased from roughly $10bn (£8.1bn, €9.1bn) in 2013 to $237bn by the end of 2019. Similarly, over the past five years, the growth in Bitcoin unique accounts and transactions has averaged nearly 60 per cent per year.

Since 2009, the crypto space has created its fair share of wealth for early adopters and investors. Some, like the Winklevoss twins or Changpeng Zhao, used their investment gains to build businesses in the crypto ecosystem. The Winklevoss twins, for instance, built the Gemini exchange, while Changpeng Zhao founded Binance, one of the largest cryptocurrency exchanges in the world.

There are plenty of other examples. Valery Vavilov used his early interest in blockchain technology to start a Bitcoin miner Bitfury. Today, the company also produces and sells hardware for Bitcoin mining and generates over $400m in revenues. Anthony Di Iorio financed some of the early development of the Ethereum blockchain and has since invested in other crypto projects like Qtum, Vechain and Zcash.

Crypto outlook: can you make money with cryptocurrency?

While the early gains in crypto have already been made, the industry remains in the initial stages of development. The internet, for example, was developed in 1969 and the World Wide Web was introduced in 1990. By comparison, cryptocurrencies have been around for just over a decade. Recent research by venture capital firm a16z shows that the crypto space evolves in cycles. A cycle generally starts with an increase in prices of the crypto assets, driving social and traditional media buzz. The coverage and excitement bring more people into the space, contributing new code, ideas and creating new projects. This eventually starts the next cycle. To date, we have seen three crypto cycles that peaked in 2011, 2013 and 2017. Despite price falls in each cycle, there has been consistent growth in developer activity, social media activity and a number of start-ups created in the space. The peak of the next cycle is likely to coincide with new technological breakthroughs and rising crypto prices. Long-term price appreciation is likely to be supported by increased interest in cryptocurrencies as an asset class by institutional investors. The daily average volume of cryptocurrencies traded is just 1 per cent of the foreign exchange market. Despite growing to over $200bn in market capitalisation, crypto assets are still a fraction of the global equity market ($71tr at the end of 2019) and the global debt market (more than $100tr at the end of 2018), not to mention global real estate. Recently disclosed position in Bitcoin by Paul Tudor Jones as an inflation hedge and the rapid growth in assets under management of Grayscale Investments are early but positive signs of institutional adoption. This backdrop presents investors and traders with opportunities to make money in the crypto space.

How to make money with cryptocurrency: six strategies to consider

There are many different ways to make money with cryptocurrency and generate income in the crypto space. Given the inherent volatility of crypto assets, most involve a high degree of risk while others require domain knowledge or expertise.

Investing

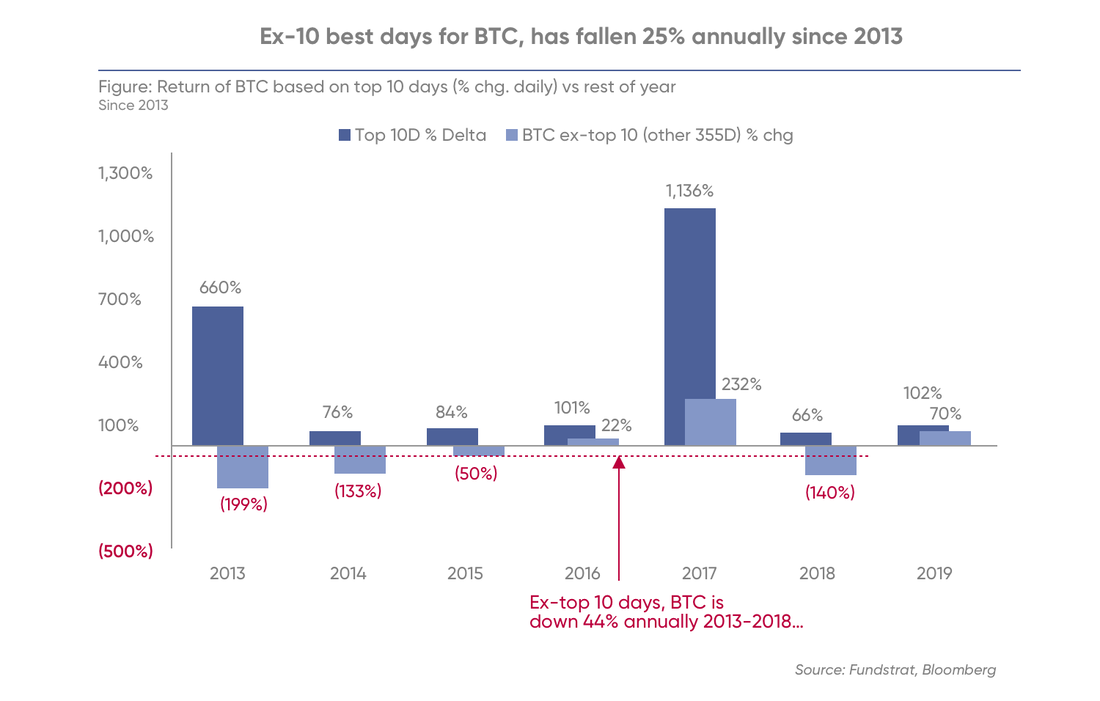

Investing is usually associated with taking a long-term view by buying and holding assets for some time. Crypto assets are generally well suited to a buy and hold strategy. They are extremely volatile in the short term but have tremendous long-term potential. Research by investment firm Fundstrat shows that the majority of Bitcoin gains come in the 10 best trading days of the year. In fact, missing these days every year between 2013 and 2018 would result in a negative 44 per cent annual return.

Because of this inherent volatility, long-term investing is one of the better approaches to make money through cryptocurrency. As with any investment, crypto should be considered in the portfolio context based on your investment goals and risk tolerance.

Trading cryptocurrency for profit The main difference between trading and investing is the time horizon. While investing is a long-term endeavour, trading is meant to exploit short-term opportunities. Trading cryptocurrencies requires certain skills and experience. Specifically, the ability to read charts and understand technical indicators. Having an in-depth knowledge of blockchain and different projects, however, is not required. This way of making money is more about understanding the price action in the historical context and using that to predict future prices, often on a short-term basis. To make money online trading cryptocurrency, investors can either buy and sell actual crypto coins or use derivatives instead, such as a contract for difference (CFD). When you trade crypto using CFDs, you speculate on the direction of the underlying asset’s prices without actually owning it. You can either take a long or short position, depending on whether you expect the price of an asset to rise or fall. Therefore, CFDs give you an opportunity to profit from both bullish and bearish price movements in underlying securities.

Top Ten Cryptocurrencies

Cryptocurrency Prices by Coinlib

CFDs allow trading on margin, providing you with greater liquidity and easier execution. However, note that CFDs are a leveraged product; therefore, profits, as well as losses, are magnified.

You can learn how to make money trading cryptocurrency CFDs with Capital.com’s comprehensive guide and trade them using our AI-powered trading platform Staking and Lending Staking and lending are quite similar and allow investors to make money with altcoins. Staking essentially means locking coins in a cryptocurrency wallet and receiving rewards to validate transactions on a Proof of Stake (PoS) network. Instead of mining, the PoS algorithm chooses transaction validators based on the number of coins they committed to stake. PoS does not require expensive hardware and is much more energy-efficient. Cold staking is also an option, allowing investors to stake coins while holding them in a secure offline wallet. Tether, NEO and Stellar (XLM) are some of the coins you can stake. With staking, investors are lending coins to the network, to maintain its security and verify transactions. Another option to earn money with crypto is to lend coins to other investors and generate interest on that loan. Many platforms facilitate crypto lending, including exchanges, peer-to-peer lending platforms and decentralised finance (DeFi) applications.

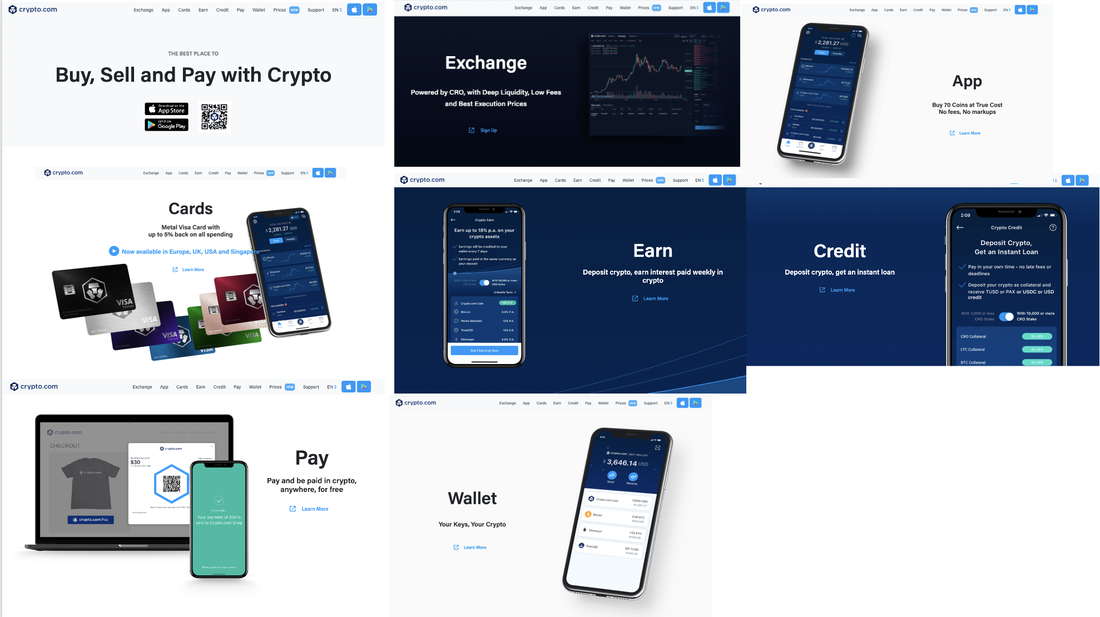

Crypto.com is the cryptocurrency and payment platform encompassing a range of products aimed at promoting the adoption of cryptocurrencies on a wider scale. At the moment, the platform offers MCO Visa cards, wallet and portfolio building services.

Use my referral link

https://platinum.crypto.com/r/sysehu49am To sign up for Crypto.com and we both get $50 USD

Crypto social media

In 2016, Dan Larimer launched Steemit, the world’s first blockchain-based social media platform. The platform rewards users with its native coin, STEEM, for creating and curating content. Steemit ran into some troubles after 2017 and the number of users has been declining since. However, multiple other platforms have been built on the initial idea of rewarding users for creating content. Narrative, Sapien and Scorum are some of the examples. Mining Mining is a crucial component of the Proof of Work (PoW) consensus mechanism and is one of the oldest ways of making money with crypto. It is a process of verifying transactions and securing a PoW network. Miners are rewarded with new coins, through block rewards, for performing these functions. In the early days of Bitcoin, mining could be done on a desktop computer but today requires specialised mining hardware. On the subject of supporting a network, running a masternode can also be profitable. Masternodes are wallets that host a copy of the entire network. Both of these methods require technical expertise and significant upfront and ongoing investment. Airdrops and forks Airdrops and forks are the crypto equivalent of being in the right place at the right time. Airdrops are free tokens, usually distributed by an exchange to generate awareness and create a large user base for a project. Forks are essentially changes or upgrades in a protocol that create new coins. When a blockchain forks, holders of the coins on the original chain typically get free tokens on the new network. Always stay on top of the latest crypto market news with TSPFinancialGroup.com to spot the best trading opportunities.

Back to Blog

Even in normal times, it can be challenging for families to cover college expenses without borrowing money and/or risking their own retirement security. For the 2019–2020 academic year, the cost of in-state tuition, fees, room, and board at a four-year public college averaged $21,950, and the total for a private college approached $50,000.1  Sadly, the college world is not immune from the health fears and financial pain inflicted by the coronavirus pandemic. More students might choose schools that are less expensive and/or closer to home, take a year off, or forgo college altogether. The American Council on Education predicted a 15% decline in college enrollment nationwide for the next academic year.2 With the financial futures of students and supportive parents at stake, it is more important than ever for families to make informed college decisions. Reopening Plans As of July 30, 2020, about 28% of the nearly 3,000 institutions tracked by The Chronicle of Higher Education had announced plans for an online fall semester, 23.5% were planning to hold classes primarily or fully in person, 16% were proposing various hybrid models of in-person classes and remote learning, and the remainder were still undecided.3 To reduce campus density and make room for social distancing in classrooms and residence halls, many colleges are inviting 40% to 60% of students back to campus (prioritizing freshman or seniors, certain majors, programs with clinical requirements, and students with unsafe home situations, for example) while expanding and improving remote teaching capabilities for students studying at home.4 Some colleges have backtracked on earlier plans to reopen due to a surge of the virus, and more could follow suit as events unfold.5 A New Landscape Students who live on campus or attend classes in person are likely to find strict rules and restrictions regarding safety practices (physical distancing, face coverings, virus testing) and changes in many facets of campus life, including living situations, food options, class settings, social gatherings, and popular extracurricular programs such as arts and athletics. Acknowledging that students are not getting the college experience they wanted and are now more price sensitive, many schools are freezing tuition, and others are offering discounts, increasing scholarships, or allowing students to defer payments.6 In anticipation of $23 billion in revenue losses, colleges nationwide have also had to lay off employees, reduce salaries, eliminate programs, and make other budget cuts.7–8 In mid-March, Moody’s Investors Service downgraded the outlook for higher education from stable to negative, citing reduced enrollment. Institutions with large endowments and/or strong cash flow are better positioned to withstand the crisis, but lost tuition poses a bigger threat to smaller colleges.9  Shopping for Schools High school students who are involved in the planning and application process might be lucky to enter college after the worst of the health crisis is over. Still, more economic hardship means that cost could play a greater role in school selection. Many students don’t pay published tuition prices, and financial aid packages differ from school to school. After identifying schools that might be a fit, families can use net price calculators to compare how generous different colleges might be, based on the household’s financial situation and the student’s academic profile. Before choosing a school, students should understand how much they might have to borrow and what the monthly payment would be after college. It’s also important to take a hard look at earning potential when choosing an academic program. Those who plan to enter lower-paying fields may fare better if they keep costs down and borrowing to a minimum. Seeking Financial Aid To receive grants and/or loans, studentsmust complete the Department of Education’s Free Application for Federal Student Aid (FAFSA) and apply for aid according to the college’s instructions as early as possible. Higher-earning families should also fill out the FAFSA because they may qualify for more need-based aid than they might expect, and some schools may require a completed FAFSA for merit-based scholarships. College students with parents who have lost a job or earned less income than normal this year due to COVID-19 may want to appeal for a revised aid package, if not for fall then for spring. The financial aid administrator may be able to reduce the loan component of a student’s aid package and/or increase the scholarship, grant, or work-study component.  Will College Pay Off? The average college graduate earns $78,000 per year, compared with about $45,000 for the average worker with a high school diploma. The wages of workers without a college degree tend to fall more during recessions, and they are more likely to be unemployed, as seen during the pandemic.10 A 2019 Federal Reserve analysis of the cost (four years of tuition and lost wages) and the benefits (higher lifetime earnings) concluded that a college degree is a sound investment for most people; the average rate of return for a bachelor’s degree is about 14%.11 When Fed economists adjusted this analysis to account for the 2020 pandemic, the return on a college degree rose to 17% (under the assumption that many workers with a high school diploma would be unemployed for a year). For a student who takes a gap year, the estimated return dropped to 13%. The $90,000 cost of a delay includes one year’s worth of post-graduation earnings and slower growth in wages over a lifetime.12 Remote learning may not be a perfect substitute for in-person interactions and relationships, especially for students enrolled at expensive institutions. Still, motivated students can grow intellectually and work toward a degree that could be valuable in terms of future earnings and social mobility. Many colleges may be able to utilize their investments in technology and online curriculums long after the pandemic passes, providing future undergraduates with more opportunities to earn an affordable college degree remotely. 1) College Board, 2019 2, 7) American Council on Education, 2020 3) The Chronicle of Higher Education, July 30, 2020 4, 9) The New York Times, July 7, 2020, and May 12, 2020 5) NPR.com, July 22, 2020 6, 8) Inside Higher Ed, April 27, 2020, and June 29, 2020 10–12) Federal Reserve Bank of New York, 2019–2020 This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek advice from an independent tax or legal professional. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2020 Broadridge Investor Communication Solutions, Inc.

Back to Blog

During These Crazy Economic Times we are all asking ourselves, how did we get here?

Covid-19/Coronavirus Black Lives Matter Police Reform Lack of True Quality Education Quality Health Care Real Estate and Financial Investing Education The US Economy These are all areas where there are not a lot of quality information and education taking place to enable people, especially black people in improving the quality of life for themselves and their families. Harvard and the New York Times have been reporting on some scary differences between blacks & hispanics, and whites. Why is there such a massive wealth gap? One of my favorite individuals "Kevin" analyzes these reasons and come up with a conclusion that could help YOU change your wealth-building strategies. |

ServicesVenture Capital Major Project Funding

Business Loans Church Loans Affordable Health Insurance Plans Kingdom Partnerships TSP 121 Coaching My Online Digital Empire VIP Ticket Orders |

Company |

|

“We are a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for us to earn fees by linking to Amazon.com and affiliated sites.”

TSP Financial Group, LLC © COPYRIGHT 2015-2030. ALL RIGHTS RESERVED.

13650 FIDDLESTICKS BLVD. SUITE 202-175, FORT MYERS, FLORIDA 33912

O: 877.528.0702 | F: 239.236.0211 | INFO@TSPFINANCIALGROUP.COM

13650 FIDDLESTICKS BLVD. SUITE 202-175, FORT MYERS, FLORIDA 33912

O: 877.528.0702 | F: 239.236.0211 | INFO@TSPFINANCIALGROUP.COM

RSS Feed

RSS Feed