Terence S. Phillips,

|

Back to Blog

Visit https://www.consumerfinance.gov/about... to learn more about coronavirus mortgage relief options under the CARES Act.

Visit https://www.consumerfinance.gov/coron... for more information about protecting and managing your finances due to the financial impact of the national coronavirus emergency. If you are experiencing difficulty making on-time mortgage payments due to the national coronavirus emergency, forbearance may be an option for you. Forbearance can help consumers get back on their feet during short-term financial difficulty, but there are a few things you need to know and some important decisions you’ll need to make. Forbearance is when your mortgage servicer, that’s the company that sends your mortgage statement and manages your loan, or lender allows you to pause or reduce your payments for a limited period of time. Forbearance does not erase what you owe. You’ll have to repay any missed or reduced payments in the future. So, if you’re able to keep up with your payments, keep making them. The types of forbearance available vary by loan type. If your mortgage is backed by the federal government—this includes FHA, VA, USDA, Fannie Mae and Freddie Mac loans—provisions of the recently enacted CARES Act allow you to suspend payments for up to twelve months if you are experiencing financial difficulty due to the impact of the coronavirus on your finances. Loan servicers may also have forbearance or deferment options for non-government backed or private loans, but the exact options available to you may differ. Here’s how this works for federally-backed mortgages under the CARES Act. If you are experiencing financial hardship due to the coronavirus pandemic, you have a right to request forbearance for up to one hundred eighty days. You also have the right to request an extension for up to an additional one hundred eighty days. But, you must contact your loan servicer to request this forbearance. There won’t be any additional fees, penalties or interest added to your account. But, your regular interest will still accrue. Other than telling your servicer that you have a pandemic-related financial hardship, you won’t need to submit additional documentation to qualify for this forbearance. It’s important to find out what options are available to you. The best place to find that information is from your loan servicer. Look for their contact info on your monthly mortgage statement. Right now, most financial institutions, including mortgage servicers, are experiencing high call volumes, so there may be long wait times to talk to someone on the phone. Regardless of the type of mortgage you have or how you communicate with your servicer, here are some things to consider. If you cannot make your mortgage payments, and you are looking to suspend or reduce your payments, you will need to work with your servicer. If you decide to move forward with a forbearance plan, ask your servicer how you will be required to pay back the amount owed after the forbearance period. Will you owe the entire unpaid amount in a lump sum once the pause period has ended or at the end of the loan term? Can the loan term be extended so that missed payments are added to the end of your mortgage? Will your subsequent monthly payments be higher for a period of time to make up the deferred amount? Finally, be on the lookout for scams and scammers looking to take advantage of consumers affected by coronavirus. You might receive fraudulent calls, emails, text messages or other “offers” to help you reduce or stop your mortgage payments. Make sure you are working directly with your mortgage servicer.

0 Comments

Read More

Your comment will be posted after it is approved.

Leave a Reply. |

ServicesVenture Capital Major Project Funding

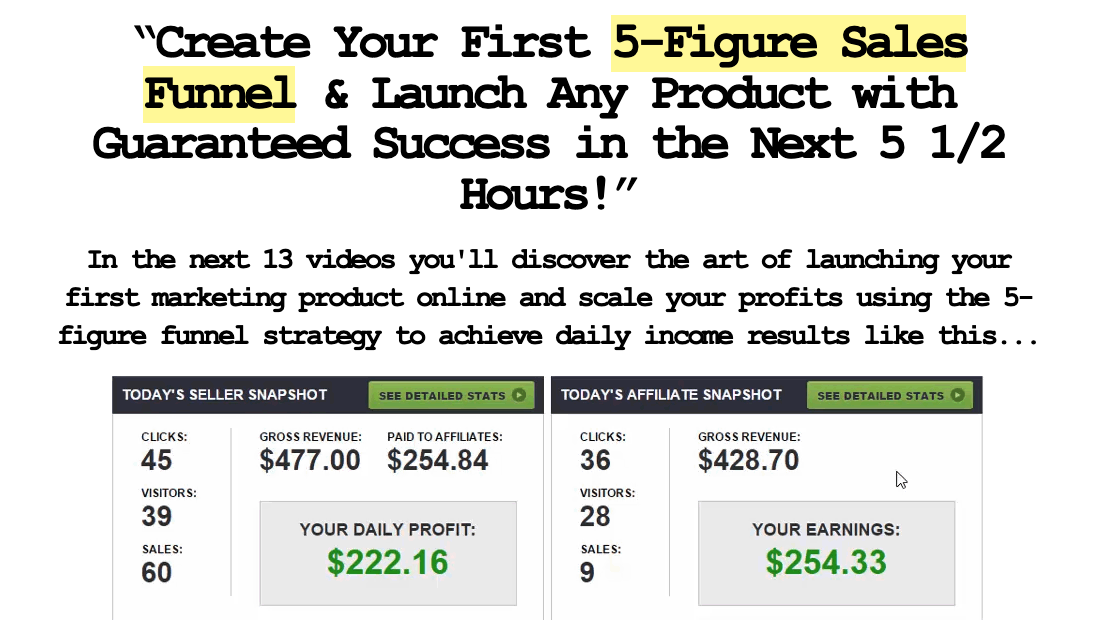

Business Loans Church Loans Affordable Health Insurance Plans Kingdom Partnerships TSP 121 Coaching My Online Digital Empire VIP Ticket Orders |

Company |

|

“We are a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for us to earn fees by linking to Amazon.com and affiliated sites.”

TSP Financial Group, LLC © COPYRIGHT 2015-2030. ALL RIGHTS RESERVED.

13650 FIDDLESTICKS BLVD. SUITE 202-175, FORT MYERS, FLORIDA 33912

O: 877.528.0702 | F: 239.236.0211 | INFO@TSPFINANCIALGROUP.COM

13650 FIDDLESTICKS BLVD. SUITE 202-175, FORT MYERS, FLORIDA 33912

O: 877.528.0702 | F: 239.236.0211 | INFO@TSPFINANCIALGROUP.COM

RSS Feed

RSS Feed