Terence S. Phillips,

|

Back to Blog

Need to find investors to launch a startup or scale your business? There’s more than one way to approach fundraising and to get noticed by those with the capital you need to get to the next level. No matter how great your product or business idea, how lean you can operate, and how big you’ve grown already, more capital and financial leverage will almost inevitably be a necessity. Even the best funded and hyper-successful billion dollar startups have been engaging in more fundraising rounds than ever before. Having enough working capital and runway to get to your next milestone is vital for giving your business the chance to live to its full potential. Of course, the chances of receiving a random call from some super-sized venture capital firm or the producers of Shark Tank are pretty small. Especially, if you haven’t already attracted some well connected investors. Thankfully, for today’s entrepreneurs, I’ve seen an increasing number of ways startups are getting noticed, found and are connecting with potential investors. If you haven’t landed the money you want for your next series yet, consider these options and then share a great pitch deck with interested parties to convince them of the potential of your business. If you need guidance, the pitch deck template by Silicon Valley legend Peter Thiel is a great example of simple story telling in slides to help you get funded. 1) Online Fundraising Platforms The past five years have given birth to virtually countless online fundraising platforms. They have become highly popular with sophisticated and accredited individual investors, angels, and even banks and funds looking for new ways to deploy capital. The major platforms run from peer-to-peer lending sites which offer business loans to donation based, debt and equity crowdfunding portals. For donations you can try Kickstarter or Indiegogo. For equity crowdfunding platforms the most popular platforms are the following: •AngelList •Seedinvest •StartEngine •CircleUp •Wefunder Even if you don’t use online platforms to raise all the money you want, they can be powerful for getting noticed. The key is finding the right match in a platform for your venture and needs, as well as being realistic about what it will take to make a campaign work. 2) Events Success in business and fundraising is all about visibility, getting noticed by the right investors, who you know, and who knows you. Attending events is a great way to achieve this. Try to find out who is attending the event ahead of time and schedule meetings to be productive. This can be pitch nights for presenting your own opportunity and meeting active investors who are there, engaging in coding marathons, or simply getting out to organized networking functions and industry trade shows. If you are operating an early stage company, you may want to consider attending any of the following events: •WebSummit •Money2020 •TechCrunch Disrupt •SXSW •Collision To get ahead of the competition and take a more passive route, consider attending other events where your investors are likely to be. Think sporting events, charity fundraisers, film festival and yacht shows. 3) Social Media Social media can be your best friend as a lean startup or solo entrepreneur looking to test the market, gain traction, and attract investors. It makes it easy to be discovered, and is still one of the most cost effective methods of reaching others. You can take an inbound approach with your own posts and updates, or take a more active approach with collaborations and leveraging sponsored posts or influencers. Direct messaging can be powerful too. If you can get the social profile handles of well fitting investors, it might only take one great message to connect with the capital your startup needs.In the event you need VCs you can always go to Crunchbase and research for those investors that are actively investing in your industry. When it comes to social media, here are the most popular channels and how to use them: •LinkedIn for cold messages or to seek quality introductions to pass the social proof with guarded investors such as Venture Capital investors. In my opinion, LinkedIn Premium is totally worth for unlocking certain features. •Facebook for meaningful relationships after you have been able to meet with an investor once or twice. It is critical to build the relationship to generate trust. •Twitter for thoughtful conversations and engagement with relevant information shared by the investor. 4) Blog Blogging is one of the most underestimated methods of attracting inbound attention, telling your story, progressing potential investors through the thought process of wanting to invest in you, and remaining visible through each series of fundraising. Even without a website or blog of your own yet, you can publish via Medium or LinkedIn. Moreover, another good option is to go to the blogs of the investors that you are looking to target. They all read their comments and often engage with responses. Leave a thoughtful comment to get noticed and start building the relationship from there. Investors that are probably the most active right now on blogs include: •Fred Wilson •Mark Suster •Hunter Walk •Brad Feld •Matt Turck •Seth Levine •Jalak Jobanputra •Fred Destin •Tomas Tunguz •Bill Gurley 5) Email Simple emails have proven to be able to get the attention of notable angel investors and VCs. They’ve even be responsible for the launch of some very important and notable startups. Here are 3 Proven Email Templates That Helped Entrepreneurs Raise Millions. 6) Apply to Accelerators Popular startup accelerator programs always have an open invitation for applications from serious entrepreneurs. If accepted, you’ll likely get a modest check to keep developing your work, as well as introductions to other investors, business advice and help in staging future fundraising rounds. Just make sure you know the terms and look for a good fit before you apply, or accept the help. Typically Accelerator programs include a demo day. This is when the startups attending the program pitch to a crowd of investors. I listed recently the ones to highly consider in the piece 10 Startup Accelerators Based on Successful Exits. In the event the accelerator that you are considering is outside of the list included in the piece above, I would highly recommend to do extensive research to verify the type of success stories and the track record from such program. You may be better off using that equity that you intended to allocate to the Accelerator to create instead a very active board of advisors and incentivize them to help with making investor introductions. 7) Start Sharing Your Product Fundraising and growth needs to be strategic to be successful. Yet, far too many entrepreneurs and startups aren’t focusing enough on just getting their product or service out there in the hands of customers, influencers, and in turn, in front of investors. If you can acquire real customers, you will be under less pressure to seek outside money. When you do, you can achieve better terms, from better investors. If sales are tough, then there are freemium and hybrid business models that can help get your product in the market, and starting to generate some buzz. 8) Bootstrap Your Business

Provided that your business isn’t operating in an industry that requires lots of startup capital, like manufacturing or transportation, you can potentially fund your own venture—and it may be more feasible than you think. For instance, even if you don’t have enough in savings to run the operation, you could get a 0% / low interest APR business credit card, offering you the chance to borrow cash for a period of time without incurring interest. Perhaps you think funding the business yourself carries lots of risk—and it does. But it’s important to consider your potential. Brent Gleeson, a leadership and team building coach specializing in organizational transformations, states, “if you believe in your vision and have an absolute refusal to accept failure as an option, you should feel comfortable investing your own money into the business.” Investing some of your own money will usually make investors and lenders more willing to partner with you down the line. 9) Raise Capital By Asking Friends and Family Raising capital through friends and family is a viable option for many. According to the Global Entrepreneurship Monitor, 5% of US adults have invested in a company started by someone they know. Caron Beesley, a content marketing specialist and SBA contributor, advises that you ideally select a friend or family member with solid business skills. She also suggests that you “narrow your list down to friends or family who have faith that you will succeed, who understand your plans, and who are clear about the risks.” Once you’ve done that, Beesley stresses that you must demonstrate passion and due diligence by having a sound business plan and direction. Also, be realistic about how much money is needed. Finally, make sure to agree on what form the funding will take. They could be a loan or equity in your company. If the money is a loan, agree to a repayment plan and use a P2P lending website to document everything and manage the loan. 10) Apply for a loan Even as technology creates new ways of raising capital, traditional financing products remain the primary way small businesses fund their operations. According to the Small Business Administration (SBA), almost 75% of financing for new firms comes from business loans, credit cards, and lines of credit. Generally speaking, the small business loans with the most favorable rates and terms are going to be SBA loans and term loans from banks and other financial institutions. To get approved, you typically need to meet requirements like the following:

These aren’t hard and fast rules and will differ depending on the lender. If you don’t qualify for a term loan with a good APR, there are other, albeit more expensive, types of funding available. If you have outstanding invoices, you could opt for invoice financing to get that money faster. Or, if you need cash for machinery, tech devices, office furniture, or something similar, consider equipment financing. Before applying for a small business loan, make sure to prepare any loan documents you’ll need to show ahead of time. You’ll be asked to show a profit and loss statement, balance sheets, tax returns and bank statements. In some cases your personal information may be checked as well.

0 Comments

Read More

Back to Blog

Venture Capital Major Project Funding4/14/2019

It's All About The Right Connections!

An Exclusive Global Community Of Elite Investors and Capital Seekers

We Can Make It Happen For You and Your Company. $25 Million - $50 Billion+

TSP Financial Group Venture Capital Funding

We Are A New Type Of Connection Platform Where We Match Investors With The Type Of Deals They Are Targeting and Seekers With The Right Investors For Their Particular Needs...

We help facilitate your transaction and project and provide whatever assistance is needed to get your project funded. We are connectors who use a proprietary software platform to enable you to streamline the process of finding and completing your transactions.

It's All About The Right Connections!

Our Venture Capital Project Funding Success Strategy

Is Really Simple and Straightforward. We like to call it our 7 Steps To Project Funding. 1. You review and sign Venture Capital Raise Engagement Agreement to begin Investor Engagement. Provide Executive Summary, Pitch Deck and Financials. We will revise Business Plans, and presentations as necessary for Investor submission. Our total engagement period extends for one-year. 2. Our Deal Review & Investor Placement Team reviews deal and will identify interested Investors’ whose portfolio requirements match your deal. You may need to provide additional documents during this initial review. 3. After initial deal review [7-10 days] and Investor identification. Capital Seeker will be sent an Investor Application to complete and provided any additional documents requested by Investor. 4. A one-hour conference call is scheduled with the Investors’ Facilitators and your team to go over the Investors’ funding process. 5. Investors' Deal Package is sent to Capital Seeker containing: Investor’s NDA, General Term Sheet, LOI, Contracts, Invitation for Investor face-to-face meeting or online meeting via Skype. 6. Capital Seeker signs LOI. 7. Final Due-Diligence, Rates, and Terms are Negotiated With Investor and Project Is Scheduled For Closing With Investor.

Our Investor Networks

TSP Financial Group utilizes members-only global accredited Investors Networks that includes Middle Eastern, Asian, Australian, Canadian and European investors. Each deal is specifically paired with potential investors who are network members. We do not shop deals on the open market. |

ServicesVenture Capital Major Project Funding

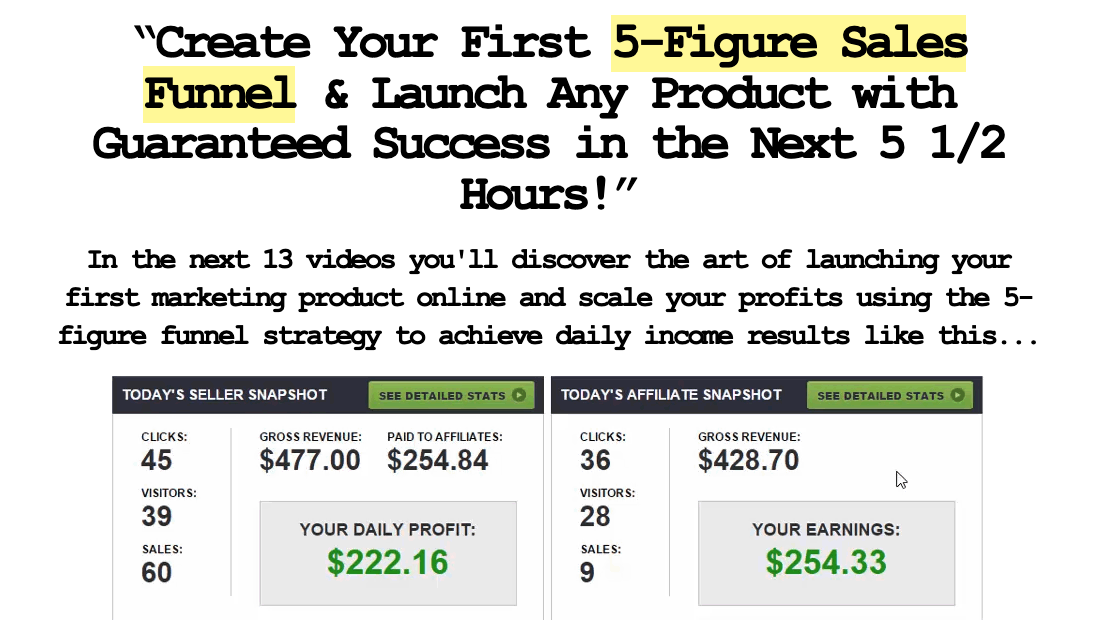

Business Loans Church Loans Affordable Health Insurance Plans Kingdom Partnerships TSP 121 Coaching My Online Digital Empire VIP Ticket Orders |

Company |

|

“We are a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for us to earn fees by linking to Amazon.com and affiliated sites.”

TSP Financial Group, LLC © COPYRIGHT 2015-2030. ALL RIGHTS RESERVED.

13650 FIDDLESTICKS BLVD. SUITE 202-175, FORT MYERS, FLORIDA 33912

O: 877.528.0702 | F: 239.236.0211 | INFO@TSPFINANCIALGROUP.COM

13650 FIDDLESTICKS BLVD. SUITE 202-175, FORT MYERS, FLORIDA 33912

O: 877.528.0702 | F: 239.236.0211 | INFO@TSPFINANCIALGROUP.COM

RSS Feed

RSS Feed